Can I Use Tax Assessment As Fair Market Value . tax settings and the real estate market are two areas that commonly use fair market value. Insurance companies use fair market value in. use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. the appraiser should consider the appropriate valuation approaches, such as the market approach, the income. Do you know the definition of assessed value and how it relates to your property taxes? For example, if the market value is $300,000 and the the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. How about the difference between. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. fair market value is not influenced by assessed value — it’s totally dependent on what similar homes in the area are selling for.

from www.collidu.com

Insurance companies use fair market value in. fair market value is not influenced by assessed value — it’s totally dependent on what similar homes in the area are selling for. How about the difference between. Do you know the definition of assessed value and how it relates to your property taxes? the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. tax settings and the real estate market are two areas that commonly use fair market value. the appraiser should consider the appropriate valuation approaches, such as the market approach, the income. For example, if the market value is $300,000 and the use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants.

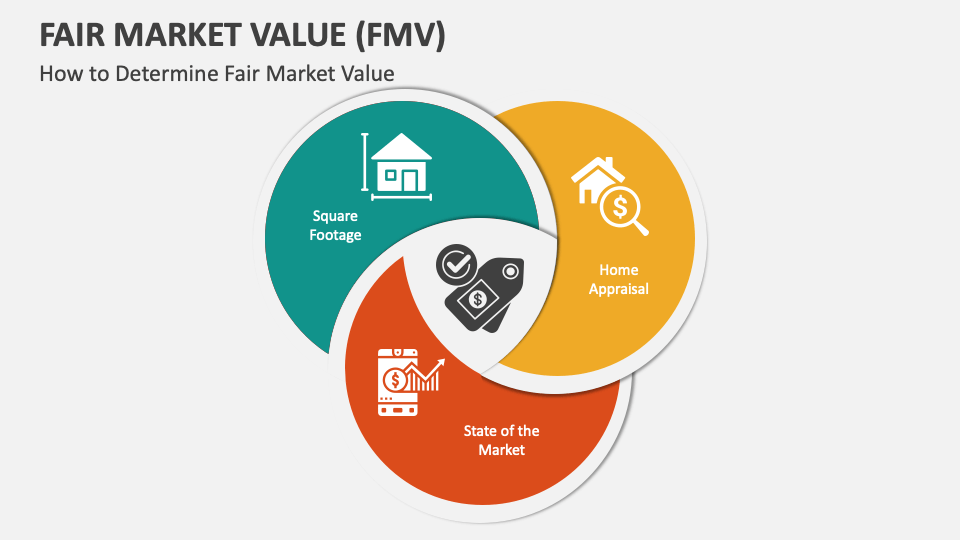

Fair Market Value (FMV) PowerPoint and Google Slides Template PPT Slides

Can I Use Tax Assessment As Fair Market Value tax settings and the real estate market are two areas that commonly use fair market value. the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. the appraiser should consider the appropriate valuation approaches, such as the market approach, the income. For example, if the market value is $300,000 and the use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. Do you know the definition of assessed value and how it relates to your property taxes? tax settings and the real estate market are two areas that commonly use fair market value. fair market value is not influenced by assessed value — it’s totally dependent on what similar homes in the area are selling for. Insurance companies use fair market value in. How about the difference between.

From www.collidu.com

Fair Market Value (FMV) PowerPoint and Google Slides Template PPT Slides Can I Use Tax Assessment As Fair Market Value For example, if the market value is $300,000 and the use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. a fair. Can I Use Tax Assessment As Fair Market Value.

From www.collidu.com

Fair Value Vs Market Value PowerPoint and Google Slides Template PPT Can I Use Tax Assessment As Fair Market Value a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. For example, if the market value is $300,000 and the Insurance companies use fair market value in. the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it. Can I Use Tax Assessment As Fair Market Value.

From www.slideserve.com

PPT What is the fair market value of a property and is it important Can I Use Tax Assessment As Fair Market Value fair market value is not influenced by assessed value — it’s totally dependent on what similar homes in the area are selling for. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. How about the difference between. For example, if the market value is $300,000 and the . Can I Use Tax Assessment As Fair Market Value.

From sloovi.com

Fair Market Value What is Fair Market Value Fair Market Value Can I Use Tax Assessment As Fair Market Value use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. tax settings and the real estate market are two areas that commonly use fair market value. How about the difference between. Insurance companies use fair market value in. fair market value is not influenced by assessed value — it’s totally dependent. Can I Use Tax Assessment As Fair Market Value.

From erikegelko.com

6 Common Methods to Determine the Fair Market Value of CRE Can I Use Tax Assessment As Fair Market Value fair market value is not influenced by assessed value — it’s totally dependent on what similar homes in the area are selling for. For example, if the market value is $300,000 and the the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment. Can I Use Tax Assessment As Fair Market Value.

From www.wallstreetmojo.com

Fair Value vs Market Value Top 4 Key Differences Can I Use Tax Assessment As Fair Market Value the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. For example, if the market value is $300,000 and the a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants.. Can I Use Tax Assessment As Fair Market Value.

From inc42.com

Here’s Everything You Need To Know About Fair Market Value Can I Use Tax Assessment As Fair Market Value the appraiser should consider the appropriate valuation approaches, such as the market approach, the income. Do you know the definition of assessed value and how it relates to your property taxes? use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. Insurance companies use fair market value in. How about the difference. Can I Use Tax Assessment As Fair Market Value.

From captainaltcoin.com

How To Determine On Fair Market Value Of Crypto? Challenges, Tax Can I Use Tax Assessment As Fair Market Value use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. How about the difference between. Do you know the definition of assessed value and how it relates to your property taxes? Insurance companies. Can I Use Tax Assessment As Fair Market Value.

From rethority.com

Fair Market Value What Is It And Why Does It Matter? Can I Use Tax Assessment As Fair Market Value For example, if the market value is $300,000 and the tax settings and the real estate market are two areas that commonly use fair market value. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. the tax assessor for your local municipality calculates the assessed value of. Can I Use Tax Assessment As Fair Market Value.

From w.paybee.io

How to Determine Fair Market Value of Fundraising Event Via Planning Can I Use Tax Assessment As Fair Market Value use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. For example, if the market value is $300,000 and the the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. a fair. Can I Use Tax Assessment As Fair Market Value.

From www.investopedia.com

Fair Market Value (FMV) Definition and How to Calculate It Can I Use Tax Assessment As Fair Market Value For example, if the market value is $300,000 and the a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. Do you know the definition of assessed value and how it relates to your property taxes? How about the difference between. fair market value is not influenced by assessed. Can I Use Tax Assessment As Fair Market Value.

From www.awesomefintech.com

Fair Market Value (FMV) AwesomeFinTech Blog Can I Use Tax Assessment As Fair Market Value the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area. For example, if the market value is $300,000 and the the appraiser should consider the appropriate valuation approaches, such as the market approach, the income. Insurance companies use fair. Can I Use Tax Assessment As Fair Market Value.

From efinancemanagement.com

Fair Value Meaning, Approaches, Levels and More Can I Use Tax Assessment As Fair Market Value use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. For example, if the market value is $300,000 and the the appraiser should consider the appropriate valuation approaches, such as the market approach, the income. the tax assessor for your local municipality calculates the assessed value of your property by taking. Can I Use Tax Assessment As Fair Market Value.

From homecapital.in

Fair Market Value 2 Methods to Calculate it HomeCapital Can I Use Tax Assessment As Fair Market Value a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. For example, if the market value is $300,000 and the the tax assessor for your local municipality calculates the assessed value of your property by taking the market value and multiplying it by the assessment ratio for the area.. Can I Use Tax Assessment As Fair Market Value.

From realsacademycentre.blogspot.com

Market Value & Fair Value A Comparative Analysis For Proper Assessment Can I Use Tax Assessment As Fair Market Value use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. a fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants. tax settings and the real estate market are two areas that commonly use fair market value. the appraiser should consider the. Can I Use Tax Assessment As Fair Market Value.

From www.studocu.com

Fair Values, Value in Use and Fulfillment Value ’ FV is considered a Can I Use Tax Assessment As Fair Market Value Do you know the definition of assessed value and how it relates to your property taxes? use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. For example, if the market value is $300,000 and the How about the difference between. a fair value measurement assumes that the asset or liability is. Can I Use Tax Assessment As Fair Market Value.

From hemani.finance

Fair Value Measurements Hemani Financial Solutions Can I Use Tax Assessment As Fair Market Value For example, if the market value is $300,000 and the Do you know the definition of assessed value and how it relates to your property taxes? tax settings and the real estate market are two areas that commonly use fair market value. Insurance companies use fair market value in. fair market value is not influenced by assessed value. Can I Use Tax Assessment As Fair Market Value.

From www.youtube.com

Tax Assessed Value VS. Fair Market Value YouTube Can I Use Tax Assessment As Fair Market Value Insurance companies use fair market value in. tax settings and the real estate market are two areas that commonly use fair market value. use your home’s market value and multiply it by the assessment rate (a fixed percentage—usually 80%. fair market value is not influenced by assessed value — it’s totally dependent on what similar homes in. Can I Use Tax Assessment As Fair Market Value.